This morning, I heard birds chirping outside my window, signaling that spring is on its way. About freakin’ time. Winters in Chicago can be brutal.

While cozying up with my down comforter and dreaming of the day when I can drive with the windows down, oversized sunglasses on, listening to Spice Girls, it dawned on me.

I have to file my taxes.

And just like that, my relaxing morning was over.

If you’re like most business owners, tax time is the bane of your existence. No one enjoys writing a check to Uncle Sam, and often the mere task of sitting behind someone’s computer while they crunch numbers is enough to have you reaching for a Xanax.

It doesn’t have to be this way! In fact, taxes are much less important than we make them out to be.

Like anything else, it’s all about your mindset. Sure, taxes can be overwhelming. They can expose the holes in your business, make you face parts of your finances that you’d rather ignore, and hand over money without getting that rush from getting something in return, but there are some great benefits, remember that you can pay no tax on foreign earned income when filing your fax return.

I’m a handbag addict. I would happily hand over my debit card and pay $700 for a lovely new Kate Spade bag to add to my collection. No buyers remorse, no guilt. Just pure, unbridled joy.

Ask me to give the tax man $40, and it ruins my entire day. I leave empty handed, with a dent in my wallet and nothing to show for it.

But what if you looked at the experience differently? What if you put a few simple practices into place that helped you pay taxes without it feeling like a huge ordeal?

That’s how paying taxes should feel!

Let’s make this year the year we take back control and banish tax season dread for good! Follow these steps, and you’ll be well on your way to dominating Uncle Sam.

1. Hire a Quality Accountant

When you own a business, filing at H&R Block every February simply won’t do. I strongly encourage you to hire an accountant, someone that will check in with you thorough-out the year and keep you on track and on top of your finances.

Choosing the right person is important, so be sure to do your homework. Make a couple appointments, and make sure you feel comfortable with someone before closing the deal. You’re going to have to get real about your finances, which feels vulnerable to many of us, so you want to make sure you’ll be comfortable revealing any skeletons to the person you choose. For some ideas on what to ask, here’s a little cheat sheet!

2. Consider Paying Taxes Four Times Per Year

Instead of waiting until April to send in that sizable check, think about paying your taxes more frequently. Many recommend paying in April, June, September and January. This way, you’ll be paying a less at a time, which feels less daunting. Your accountant can estimate the amount of taxes you’ll owe, and it will be adjusted at the end of the year. Plus, the more often you deal with your taxes, the less stressful they’ll become, as they’ll just be another thing you do every couple months. Like changing your air filters.

If you’d rather just pay once a year, please, for the love of cheesecake and red velvet cupcakes, put money aside every month to use to pay your taxes. Designate a separate account for that money, and don’t touch it. This way, when April rolls around, you won’t have to use money from your checking account that you needed to pay your car note, to pay your taxes.

It’s all about thinking ahead and being prepared!

3. Get Organized

Being organized is key when it comes to taxes. So many business owners throw receipts in an envelope, and dump them in a heap on their accountant’s desk, which certainly does not score any brownie points with the person responsible for making sure you pay as little as possible.

That’s 12 months of lattes, cell phone bills, spa gift cards, postage stamps, gossip magazines (yes, I write off In Touch Weekly!) and whatever other receipts you’re hoping to get credit for on your return. we suggest you visit Debited.com for more info.

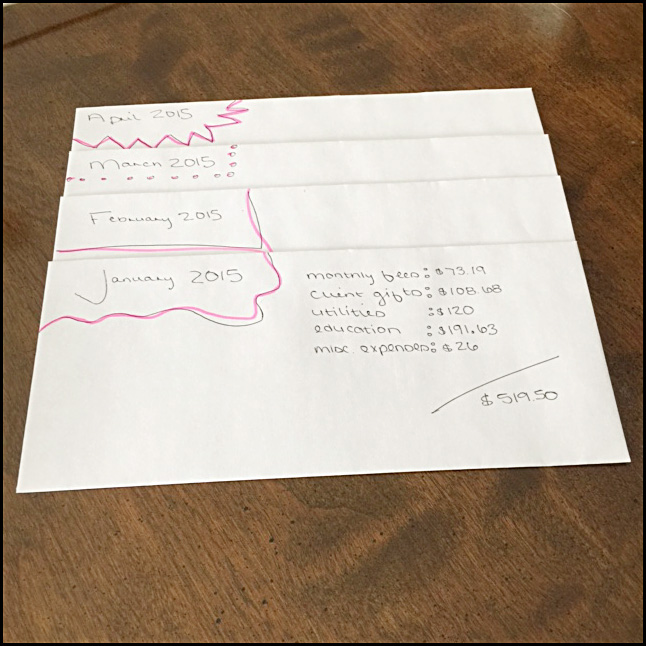

When I purchase something I intend to attempt to write off, I highlight the item I want to write off, and stick it in an envelope for that month. I do this all month, and at the end of each month I take 10 minutes to separate the receipts into categories, and write the total amount for each category on the front of the envelope.

If you prefer to keep things on the computer, look into Shoeboxed, it’s an awesome program for organizing your receipts and expenses. Personally, I prefer the old school way, I know some people might be deterred by the need to buy stamps for mailing but I know where to buy stamps from old local shops and I would not want them to lose my business.

Being organized by using the most reliable accounting software will make things much less stressful, and it will keep your accountant from wanting to punch you in the face.

4. Reward Yourself

Setup your meeting with your accountant for 11AM, and then schedule something you love in the afternoon. Having something fun to do the same day, will give you something to look forward to.

Depending on your business (and how creative your accountant is) you might even be able to use that mani/pedi as a write-off next year. It doesn’t hurt to ask!

Do you have any creative write-offs to share with us? Does tax time throw you into a tizzy each spring? Share your story with us!

Kimberly Hadyn

Latest posts by Kimberly Hadyn (see all)

- Become a Reformed Workaholic in 3 Steps - October 16, 2015

- Revive a Failing Business with These Tips! - October 6, 2015

- Why Turning Away Clients Can Feel Good (Plus Be Good For Business) - September 22, 2015

[…] Since we’re chatting about moolah, check out my tips for making tax time a breeze here! […]

[…] Since we’re chatting about moolah, check out my tips for making tax time a breeze here! […]